Empowering Consumers: The Best Catalogues for Bad Credit Customers in the UK can provide a solution for individuals struggling to obtain credit due to past financial issues. Bad credit can limit access to traditional loans and credit cards, making it challenging for some consumers to purchase essential items. However, with the rise of catalogues specifically tailored for individuals with poor credit scores, there are now more options available for those looking to rebuild their credit and access necessary products.

These catalogues often feature flexible payment plans, low credit score requirements, and a range of products to choose from. This can be particularly beneficial for individuals looking to make necessary purchases while also working towards improving their credit score. By offering a more accessible and inclusive shopping experience, these catalogues are helping to empower consumers and provide them with the opportunity to rebuild their financial standing. In the following sections, we will explore the key takeaways from the best catalogues for bad credit customers in the UK, helping consumers make informed decisions and take control of their finances.

key Takeaways

1. Consumers with bad credit in the UK have limited options for purchasing items on credit, but catalogues can provide a solution.

2. Popular catalogues in the UK that cater to bad credit customers include BrightHouse, The Brilliant Gift Shop, and Studio.

3. BrightHouse offers a wide range of products for purchase on credit, but the interest rates can be high so it’s important to compare options.

4. The Brilliant Gift Shop offers a variety of items on credit, with flexible payment options and no interest if paid in full within a certain period.

5. Studio is another catalogue option for bad credit customers, offering a variety of products with affordable weekly payment plans.

What are the best catalogues for bad credit customers in the UK?

Understanding Bad Credit Catalogues

Bad credit catalogues are designed to cater to individuals with poor credit scores. These catalogues offer a way for consumers to purchase goods on credit, even with a less-than-ideal credit history.

Benefits of Bad Credit Catalogues

One of the main advantages of bad credit catalogues is that they provide an opportunity for consumers to rebuild their credit. By making timely payments on purchases, customers can improve their credit score over time.

Top Catalogues for Bad Credit Customers

Some of the best catalogues for bad credit customers in the UK include Studio, Freemans, and Fashion World. These catalogues offer a wide range of products, flexible repayment options, and opportunities for credit-building.

How to Choose the Right Catalogue

When selecting a bad credit catalogue, it’s essential to consider factors such as interest rates, fees, product selection, and customer service. Researching and comparing different options can help consumers find the best catalogue for their needs.

Tips for Using Bad Credit Catalogues Responsibly

- Make sure to only borrow what you can afford to repay

- Pay attention to interest rates and fees

- Make timely payments to avoid negative impacts on your credit score

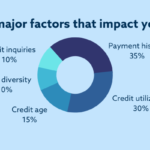

- Monitor your credit utilization and strive to keep it low

FAQs

What are catalogue credit accounts and how can they help bad credit customers in the UK?

Catalogue credit accounts are like shopping accounts that allow customers to buy items on credit and pay back in instalments. For bad credit customers in the UK, these catalogues provide an opportunity to rebuild their credit score by making timely payments.

How can bad credit customers qualify for catalogue credit accounts?

Bad credit customers can qualify for catalogue credit accounts by providing proof of income and demonstrating their ability to make regular payments. Some catalogues may also offer credit building options for those with poor credit scores.

What are some of the best catalogues for bad credit customers in the UK?

Some of the best catalogues for bad credit customers in the UK include Very, Studio, and Littlewoods. These catalogues offer affordable payment options and a wide range of products to choose from.

Are there any risks associated with using catalogue credit accounts for bad credit customers?

One of the risks associated with using catalogue credit accounts for bad credit customers is the temptation to overspend. It’s important for customers to be disciplined with their purchases and make timely payments to avoid further damaging their credit score.

How can bad credit customers use catalogue credit accounts to improve their credit score?

Bad credit customers can use catalogue credit accounts to improve their credit score by making regular payments on time and keeping their credit utilization low. By demonstrating responsible borrowing habits, customers can gradually rebuild their credit score.

What happens if a bad credit customer defaults on their payments for a catalogue credit account?

If a bad credit customer defaults on their payments for a catalogue credit account, it can have a negative impact on their credit score and may result in additional fees and charges. It’s important for customers to communicate with the catalogue provider and explore options for repayment.

Can bad credit customers apply for multiple catalogue credit accounts at the same time?

Bad credit customers can apply for multiple catalogue credit accounts at the same time, but it’s important to be mindful of the impact on their credit score. Multiple credit applications within a short period can signal financial instability to lenders.

Are there any alternatives to catalogue credit accounts for bad credit customers in the UK?

Some alternatives to catalogue credit accounts for bad credit customers in the UK include secured credit cards, credit builder loans, and guarantor loans. These options can also help customers rebuild their credit score over time.

What are some tips for bad credit customers to responsibly manage their catalogue credit accounts?

Some tips for bad credit customers to responsibly manage their catalogue credit accounts include setting a budget for purchases, making timely payments, and monitoring their credit score regularly. It’s also important to avoid maxing out credit limits and to only borrow what can be comfortably repaid.

How can bad credit customers find the best catalogue deals and promotions in the UK?

Bad credit customers can find the best catalogue deals and promotions in the UK by regularly checking the websites of popular catalogues, signing up for newsletters, and comparing offers from different providers. It’s important to look for discounts, flexible payment options, and low-interest rates.

Final Thoughts

In conclusion, catalogue credit accounts can be a valuable tool for bad credit customers in the UK to empower themselves financially and improve their credit score. By using these accounts responsibly, customers can access much-needed goods and services while working towards a brighter financial future. It’s important for bad credit customers to educate themselves on the terms and conditions of catalogue credit accounts, set realistic budgets, and prioritize making timely payments to maximize the benefits of these financial products.