Bad credit catalogues offer a unique shopping experience for consumers who may have struggled with their credit history. These catalogues allow individuals with poor credit scores to still access a wide range of products, from electronics to home goods, through a credit account. This can be a game changer for those who have been turned down for traditional credit cards or loans due to their credit score, as it provides them with a way to make purchases and rebuild their credit at the same time.

One of the key benefits of bad credit catalogues is the opportunity for consumers to improve their credit score over time. By making regular, on-time payments towards their purchases, individuals can demonstrate responsible financial behavior to credit bureaus. This can help to gradually boost their credit score and open up more opportunities for traditional credit options in the future. In the upcoming section, we will delve into some key takeaways regarding the benefits of bad credit catalogues for consumers.

key Takeaways

1. Bad credit catalogues offer consumers with poor credit the opportunity to shop for essential items and improve their credit score at the same time.

2. These catalogues provide a convenient way for individuals to access credit without undergoing a traditional credit check, making it easier for those with bad credit to get approved.

3. By making regular, on-time payments on purchases from bad credit catalogues, consumers can demonstrate responsible financial behavior and potentially increase their credit score over time.

4. Many bad credit catalogues offer flexible payment options, allowing customers to spread out payments over several months and avoid falling into debt.

5. While bad credit catalogues may come with higher interest rates and fees, they can still be a valuable tool for rebuilding credit and accessing essential items for those with limited options.

What are the Benefits of Bad Credit Catalogues for Consumers?

Access to Products and Services

One of the main benefits of bad credit catalogues is that they provide consumers with access to a wide range of products and services that they may not be able to purchase otherwise. This can include everything from electronics and furniture to clothing and appliances.

Build or Repair Credit

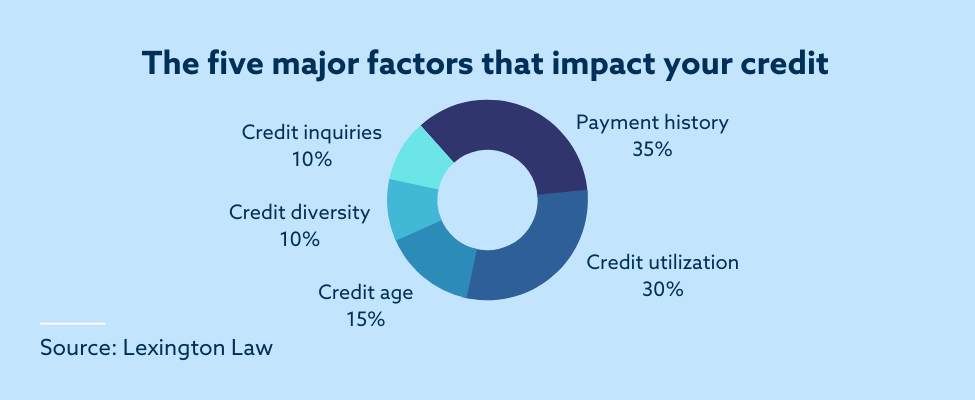

Another advantage of using bad credit catalogues is that they can help consumers build or repair their credit. By making regular payments on time, consumers can demonstrate responsible financial behavior, which can positively impact their credit score over time.

No Credit Checks

Unlike traditional lenders, bad credit catalogues typically do not require a credit check for approval. This makes them a viable option for consumers with less-than-perfect credit who may have difficulty obtaining financing through other means.

Flexible Payment Options

Many bad credit catalogues offer flexible payment options to accommodate consumers’ financial situations. This can include weekly, bi-weekly, or monthly payment plans, as well as the ability to pay off the balance early without incurring penalties.

Convenient Online Shopping

Bad credit catalogues allow consumers to conveniently shop online from the comfort of their own homes. This can be especially beneficial for individuals with mobility issues, busy schedules, or limited access to brick-and-mortar stores.

What are the Types of Bad Credit Catalogues?

- Pay Weekly Catalogues

- Buy Now, Pay Later Catalogues

- No Credit Check Catalogues

- Instant Approval Catalogues

- Electronics Catalogues

FAQs

What are bad credit catalogues?

Bad credit catalogues are catalogs offered by retailers that allow consumers with poor credit to purchase products on credit. These catalogs typically do not require a credit check and offer flexible payment options to help consumers rebuild their credit.

How can bad credit catalogues benefit consumers?

Bad credit catalogues can benefit consumers by providing them with access to products they may not be able to afford otherwise. These catalogs also offer the opportunity to improve credit scores through responsible repayment practices.

What types of products are available through bad credit catalogues?

Bad credit catalogues offer a wide range of products, including clothing, electronics, home goods, and more. Some catalogs also offer a selection of top brands and designer items.

Are there any downsides to using bad credit catalogues?

While bad credit catalogues can be beneficial for consumers with poor credit, they typically come with higher interest rates and fees compared to traditional credit options. It is important for consumers to carefully review the terms and conditions before making a purchase.

How can consumers improve their credit using bad credit catalogues?

Consumers can improve their credit by making on-time payments on their bad credit catalogue purchases. By demonstrating responsible borrowing habits, consumers can gradually rebuild their credit over time.

Are there any alternatives to bad credit catalogues for consumers with poor credit?

Consumers with poor credit may also consider using secured credit cards or credit builder loans to improve their credit. These options can help consumers establish a positive credit history and qualify for better financing terms in the future.

Can bad credit catalogues help consumers with limited credit history?

Yes, bad credit catalogues can be a good option for consumers with limited credit history. By making timely payments on their catalog purchases, consumers can establish a positive credit history and improve their credit scores.

Do bad credit catalogues report to credit bureaus?

Some bad credit catalogues report consumers’ payment history to credit bureaus, which can help improve their credit scores over time. It is important for consumers to confirm whether the catalog reports to credit bureaus before making a purchase.

How can consumers find reputable bad credit catalogues?

Consumers can research online reviews, ask for recommendations from friends and family, and check with the Better Business Bureau to find reputable bad credit catalogues. It is important to choose a catalogue that offers transparent terms and fair pricing.

Are there any restrictions on who can use bad credit catalogues?

Most bad credit catalogues require consumers to be at least 18 years old and have a valid form of identification. Some catalogues may also have income requirements to ensure consumers can afford their purchases.

Final Thoughts

Breaking Down the Benefits of Bad Credit Catalogues for Consumers highlights the potential advantages and considerations for individuals with poor credit looking to make purchases on credit. While bad credit catalogues can offer access to products and the opportunity to rebuild credit, it is crucial for consumers to carefully review the terms and fees associated with these catalogues. By using bad credit catalogues responsibly, consumers can take important steps towards improving their financial health and credit scores.

Ultimately, whether bad credit catalogues are the right choice for consumers will depend on their specific financial situation and credit goals. It is important for consumers to weigh the benefits and drawbacks of using bad credit catalogues and consider alternative credit-building options before making a decision.